I just wanted to post this up quickly as I found this while cleaning up my room. Everytime my iHerb package arrived, it came with a stack of documents from Jabatan Kastam Diraja Malaysia.

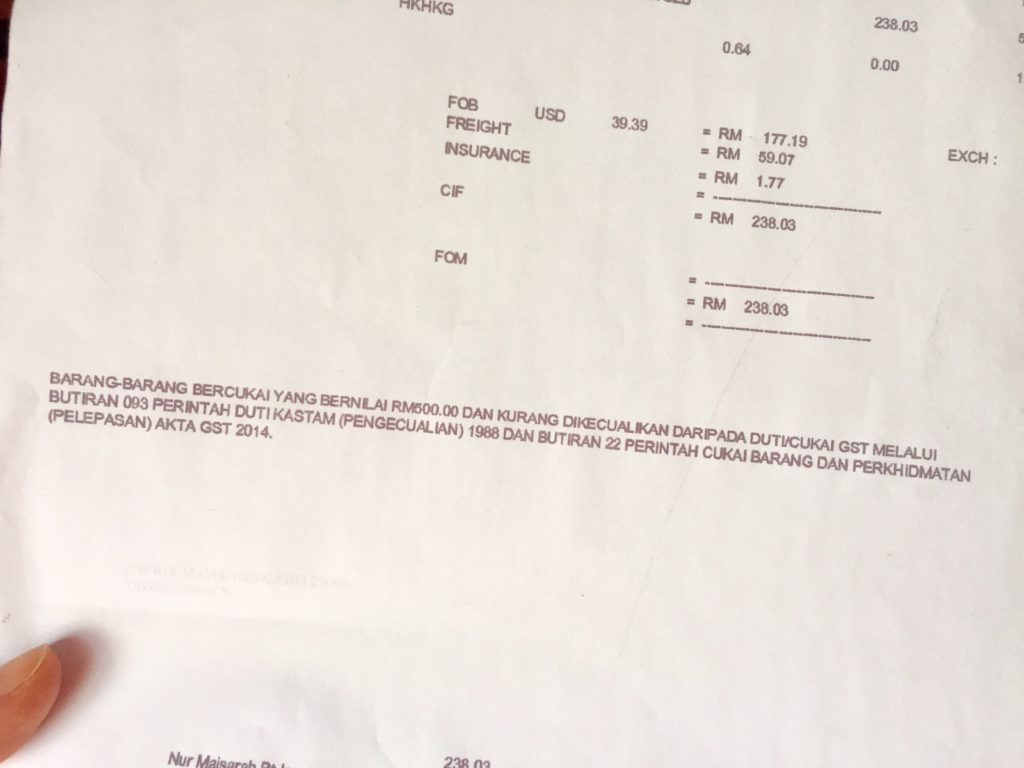

I get this question a lot. Have I ever been charge with custom duty for my iHerb haul. Touch wood, as of today all my purchases was cleared. I have heard so many stories on how they are slapped with duty charges more than their purchase value. To my understanding, purchase value of RM500 and above including shipping fee are eligible to pay for duty. All this while I have kept my purchase value as low as possible. The max I have bought was RM300 more or less.

So people say DHL especially Express Shipping are most likely to get caught in custom duty. I am not sure if that is true. What do you think?

Comments (4)

Depends on the HS code too. And, if you’re lucky enough to go under the radar.

I have been charged duty and customs brokerage for items under RM500.

It’s no wonder some was taxed and some don’t. I heard one of our friend was charged more than her RM170 purchase last time. I was so paranoid with the garcinia cambogia supplement stash I bought one time that I insist to collect the parcel from DHL office haha!

I’ve shopped up to 700 via regular post and luckily never got charged. From iHerb usually I don’t go I’ve $60 and dhl shipping… never been charged.

Just this year I’m noticing a lot of people talking about customs charges, makes me feel scared.

I’m just wondering, dhl or FedEx are duty paid beforehand, no?

I heard regular post is more flexible but like ShopGirl mentioned, it depends on the HS code and I say luck as well 🙂

Nope. DHL and UPS are not duty paid beforehand. For example iHerb…when you are the check out page, you will notice small disclaimer under the shipping option of DHL and UPS which says “Duties and Taxes may be collected at delivery.”